More at stake than the ROGERS-SHAW deal.

Acquisitions in general - and more specifically, the large ones - tend to dominate business headlines and attract media attention and discussions. Some believe in acquisitions, typically the ones on the buyer side, and some do not, generally, the ones being acquired. Regardless of where you stand, here is what business experts say motivate companies to make acquisitions:

Acquisitions allow a company – overnight - to gain new customers, add new products/services, diversify its business, obtain new technologies, and/or develop more efficiencies. These business reasons sound strategic and valid, and they are until you discover that according to recent Harvard Business Review research, the failure rate of mergers and acquisitions (M&A) sits between 70% and 90%. That is an incredible high rate of failure considering that large acquisitions typically involve an army of top experts, advisors, accountants, and lawyers that should influence M&A success.

In my opinion, most acquisitions are fundamentally motivated by the desire to acquire market share. Why market share? Larger market share gives you better control over price, and better control over pricing gives you improved profitability.

While the long list of benefits can be valid reasons for acquisitions, the reality is that the vast majority of acquisitions are motivated by a desire to have a dominant market share position. Dominant market share is great, but what if the end result in a monopoly, or even an oligopoly?

A monopoly is when a single entity produces goods and services with no close substitute, such as the Liquor Control Board of Ontario (LCBO). An oligopoly, however, is when a small number of relatively large entities produce a similar control over the marketplace, such as the recent deal proposed by Rogers-Shaw.

Canada’s telecom sector is already a controlled industry regulated by the Canadian Radiotelevision and Telecommunications Commission, known as the CRTC. The existing main five players in BELL, TELUS, ROGERS, SHAW and COGECO already make up an oligopoly. If the deal goes through and is approved by the government, the proposed merger will make it an even more powerful oligopoly.

The challenges facing the Canada Telecom industry (and influencing what each of us already pay for cell phone services) are many: higher rates, coverage of vast geography with limited population, the need to make large investments for the 5G network infrastructure, serious security considerations (with our allies) for usage or not usage of foreign made telecom equipment, etc.

Now more than ever, a long-term strategy with good coordination between the telecoms and the government is needed - not even fewer players controlling the market.

Some may argue that few strong players in a regulated market is better than many small players in a free unregulated market. But a global competitive landscape dictates stronger partnership between government and private businesses. Just look at what’s proved effective in other parts of the world. In the United Kingdom, cellphone subscribers can choose from services offered by British, French, Spanish and German companies. In Australia, customers can pick from Australian, British, Singaporean, and Hong Kong-based providers. We in Canada, have only Canadian providers to choose from.

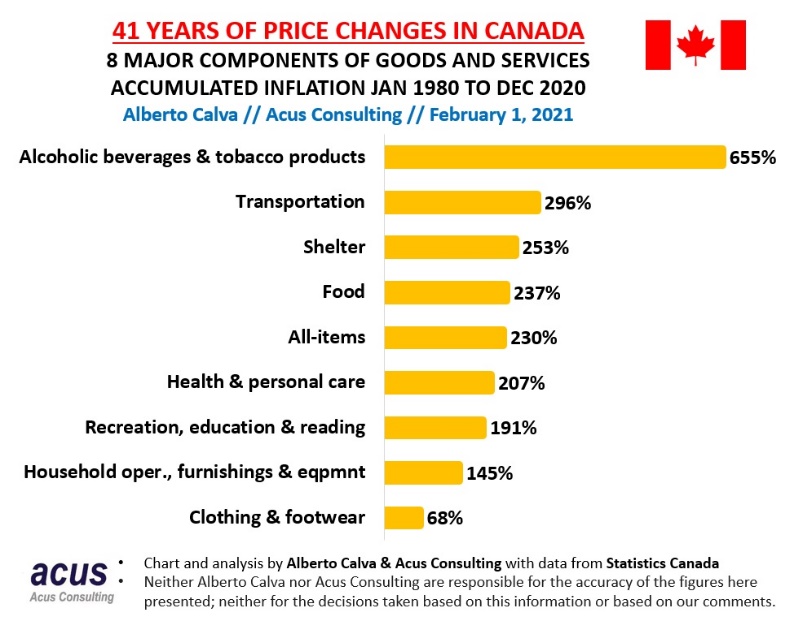

Competition makes market more efficient. If in doubt, review the following table provided courtesy of ACUS Consulting that compares various industries in Canada. Alcoholic beverages and tobacco products, a highly controlled product had a whopping 655% price increase vs. clothing and footwear products that increased prices by only 68% over a 40-year period. Restricting free competition may achieve some benefits short term, but the damage over the long term can be enormous.

Our cell phone rates in Canada already are among the highest in the world. Is a telecom oligopoly really what’s best for us?

The CRTC needs to not only make a decision on the ROGERS-SHAW deal but needs to focus on better efficiencies, better quality communication and tighter security, all with urgency. The global industry is already looking ahead to 6G, which is expected to be deployed by 2030. That is only 9 years ahead! The competitive global arena is getting tougher by the day.

Bottom line: Ottawa and the telecoms need to get their act together and work better closely and fast to avoid Canada falling further behind.